Insurance suppliers use deductibles to help in reducing their danger entailing you, the insured party. What Is an Automobile Insurance Deductible? When you need your insurer to pay for repairs to your automobile, they will certainly require you to pay your insurance deductible. The deductible is the amount of cash you agreed to pay up front for fixings prior to the insurance policy company kicks in to pay for the remainder.

Not all automobile insurance policy coverage needs an insurance deductible, but you will generally find a insurance deductible is called for for the list below kinds of insurance coverage, according to Progressive: Comprehensive, Accident, Injury security, Uninsured/underinsured driver, The deductible will certainly work the exact same means no matter the insurance coverage type and will be needed at any time you make a case.

Comprehensive insurance policy covers things that don't include another driver. You may also have to pay your insurance deductible if your windscreen is broken, although some insurance provider do offer full glass coverage as an option. Are There Times When No Insurance Deductible Is Required? There are conditions in which no insurance deductible will be required.

So even though you triggered the accident, you do not need to pay anything out of pocket when someone makes a claim versus your liability insurance for damages you create to their residential or commercial property or for injuries. Various other scenarios where you won't be required to pay an insurance deductible include: An insured vehicle driver strikes you (insurance company).

cheapest auto insurance car insurance affordable affordable auto insurance

cheapest auto insurance car insurance affordable affordable auto insurance

You choose for free repairs on your glass. Being involved in a mishap with another insured vehicle driver, where the crash is regarded their fault, implies you will not have to pay a deductible because you'll be making a claim with their liability insurance policy. You do have the alternative to make a case with your own collision insurance coverage, if you have it.

How How An Insurance Deductible Works can Save You Time, Stress, and Money.

When speaking with Allstate, we figured out that, depending on the state you reside in and also the insurance policy provider you utilize, there is a zero-deductible alternative available. insure. Of course, selecting a zero-deductible choice on your insurance plan will likely lead to a higher monthly premium. This is due to the fact that all the risk is now thought by the insurance provider.

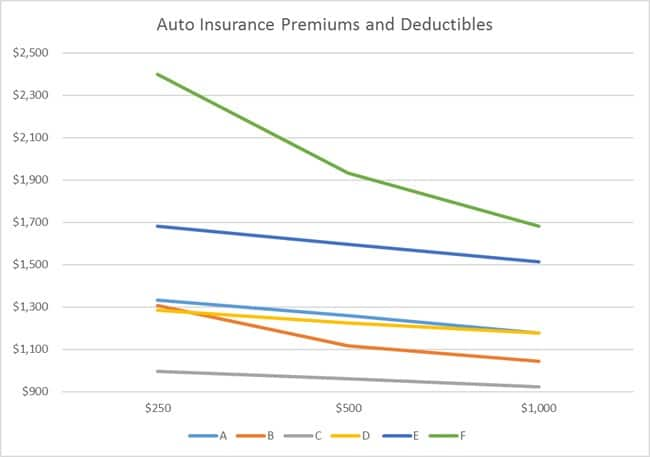

However, the finest amount for you will depend upon your economic situation due to the fact that your deductible impacts your monthly premium price. Dynamic suggests that you keep this in mind when determining what amount to set for your deductible: A higher insurance deductible implies a reduced month-to-month premium, yet a higher out-of-pocket expense when making an insurance claim.

Recognizing what your auto insurance deductible is and also when you need to pay it is a crucial facet of deciding what kind of insurance coverage you want. Ensure you'll be able to cover the insurance deductible quantity when you make a claim to your insurance policy business to stay clear of any problems with getting repairs cared for in a prompt way. trucks.

For any type of responses or adjustment requests please call us at. Resources: This content is created and kept by a 3rd party, and also imported onto this page to assist individuals supply their email addresses. You may be able to discover even more info concerning this and similar material at - vehicle insurance.

The auto insurance deductible is the quantity of money you will certainly first be accountable for before the insurance provider starts to cover prices. Unlike health and wellness insurance coverage, automobile insurance coverage deductibles are typically on a per claim basis significance you would need to cover these prices every single time you sue.

Examine This Report about What Is A Car Insurance Deductible? – Forbes Advisor

does not cover the damages you triggered to various other people's residential property Covers damages done to your vehicle in all instances aside from a collision in which you are at fault. This includes points like dropping tree limbs, or any kind of various other kinds of damage that your vehicle might sustain. Just how does the deductible job? Your insurance deductible, generally around $750 will be initial put on any type of damages - liability.

The continuing to be $2,750 would certainly then be covered through the crash coverage by your insurance company. In some situations where one more motorist is at fault for the mishap you might wish to file a third-party claim versus their Under these scenarios your insurance company might pursue a procedure called subrogation to recover the quantities they have currently paid.

You can find out more in our write-up on? Picking the best auto insurance deductible amount Your first consideration when picking your insurance deductible is just how much you would be able to pay in case of a case. insurance company. sell you coverage for a revenue, the more risk defense you purchase the even more they benefit as well as the lower your insurance deductible the more danger security you are getting.

It is additionally crucial to bear in mind that given that vehicle insurance deductibles are on a per-claim basis so the regularity of your insurance claims will certainly be just one of one of the most crucial variables (accident). If your policy has a $500 insurance deductible and you were involved in four different insurance claims of much less than $500, then you would certainly be in charge of 100% of all the payments and also your insurance coverage would certainly have supplied no protection.

cheaper cars low cost insurers auto

cheaper cars low cost insurers auto

One method you can take is to consider your driving and also lorry background - insure. If your background suggests that you may require to make more frequent claims, you may want to think about choosing a plan with reduced out of pocket expenses. On the other hand, if you haven't had a background of crashes you might not need a low deductible strategy.

What Does What Does Deductible Mean In Car Insurance? Do?

You are in charge of the first $1,000 of problems as well as your insurance coverage firm is accountable for the various other $1,000 of covered problems. Collision as well as thorough are the two most common coverages with a deductible. Crash-- this coverage assists spend for damage to your automobile if it hits an additional automobile or item or is struck by one more cars and truck (laws).

There are also a few other things to know regarding deductibles. There are no deductibles for liability insurance coverage, the insurance coverage that pays the other person when you create an accident. Cars and truck insurance coverage deductibles use to each mishap you remain in. If you obtain into 3 mishaps in a policy duration and also have a $500 insurance deductible, you'll commonly be responsible for $500 for each case.

What is a Vehicle Insurance Coverage Deductible? Your auto insurance policy deductible is the amount you'll be accountable for paying in the direction of the costs due to a loss prior to your insurance protection pays.

Picking a greater deductible may lower your vehicle insurance coverage premium. When Do You Pay a Vehicle Insurance Coverage Deductible?

What Are Liability Restrictions and Exactly How Do They Work? Your vehicle insurance policy responsibility coverage limits, additionally described as restriction of liability, are the most your insurance policy will pay to an additional celebration if you are legally accountable for an accident. cheap auto insurance. Picking a greater limit offers you more security if a Extra resources mishap occurs.

The Best Guide To What Is A Car Insurance Deductible? - Credit Karma

Contact your regional independent representative or Travelers representative to discover about the insurance coverages and also liability restriction that is ideal for you. What are Personal Responsibility Umbrella Policies and also Are They Needed? An umbrella policy is additional responsibility protection over the restrictions of your cars and truck insurance plan. Umbrella policies are not called for as well as readily available insurance coverage limits and also qualification requirements might vary by state.

cheapest cheaper cheapest car insurance insurance

cheapest cheaper cheapest car insurance insurance

Learn what a cars and truck insurance deductible is as well as how it affects your auto insurance policy protection. The key is recognizing what deductibles and insurance coverages are and also how they influence vehicle insurance.

What is a deductible? Put merely, a deductible is the amount that you consent to compensate front when you make an insurance claim, while the insurance firm pays the remainder as much as your protection limit. When picking your auto insurance coverage deductible, consider just how much you want to pay of pocket if you need to make a case - vehicle insurance.

It really boils down to what makes you one of the most comfortable. Car insurance coverage plans usually contain numerous sort of insurance coverages - car. Due to the fact that insurance legislations differ from one state to another, the following info is here to provide you a wide summary of regular protections, and also it isn't a declaration of contract.

Uninsured vehicle driver This coverage pays for problems if you or an additional covered person is hurt in an automobile accident triggered by a motorist that does not have responsibility insurance coverage. In some states, it may additionally pay for property damages.

A Biased View of What Is A Car Insurance Deductible?

It differs by state and also depends upon plan stipulations. Underinsured motorist insurance coverage undergoes a policy limits chosen by the guaranteed. Rental reimbursement This coverage spends for service expenses if your cars and truck is disabled as a result of a covered loss. Daily allocations or limits differ by state or plan stipulations.

An insurance deductible is what you pay out of pocket to fix your auto prior to your cars and truck insurance policy pays for the rest. If you lug extensive as well as collision protection on your auto insurance policy, you will see an insurance deductible listed on your policy as a buck amount.

When do you pay your insurance deductible? You just pay the insurance deductible for repair work made to your own vehicle.

auto insurance auto automobile cheapest auto insurance

auto insurance auto automobile cheapest auto insurance

This is where the value of your automobile can be a huge element. For that reason alone, you might see a large cost jump in your premium if you go with the reduced insurance deductible - prices.

Yet if you're still favoring a greater deductible, consider this: The length of time would it take to recoup what you'll invest on premium costs? If it's simply going to take you a year or 2, the greater insurance deductible may still be looking excellent - vehicle insurance. Otherwise, the lower deductible may make more sense.

The Best Strategy To Use For Michigan's Auto Insurance Law Has Changed

Think of exactly how you utilize your auto. Where do you live? Where do you drive to? Where do you park? If you stay in a quiet neighborhood with a brief commute to work, you might be comfortable with a greater deductible. Ultimately, it's your phone call. Be sure and also talk to your ERIE agent to assist you determine which plan is appropriate for you.

The cash we make aids us provide you accessibility to complimentary credit rating and records and helps us create our other great tools as well as educational products. Compensation may factor right into exactly how as well as where products show up on our system (as well as in what order). automobile. Yet given that we usually generate income when you discover a deal you such as and obtain, we attempt to reveal you offers we think are an excellent suit for you.

Obviously, the offers on our system don't represent all monetary products around, yet our objective is to show you as several wonderful alternatives as we can - cheaper. Baffled concerning how an automobile insurance policy deductible works? When looking for cars and truck insurance policy, you'll likely discover words "deductible" as well as may ask yourself how it affects you and also your insurance expenses as well as when you'll actually require to utilize it.