Just how much does your insurance go up after including a teenager is a concern we obtain at all times. If you're a parent of an adolescent driver after that you recognize it's pricey! We're mosting likely to speak about exactly how pricey it is and give some tips on exactly how to lower your automobile insurance coverage premium for young teenage vehicle drivers - insurers.

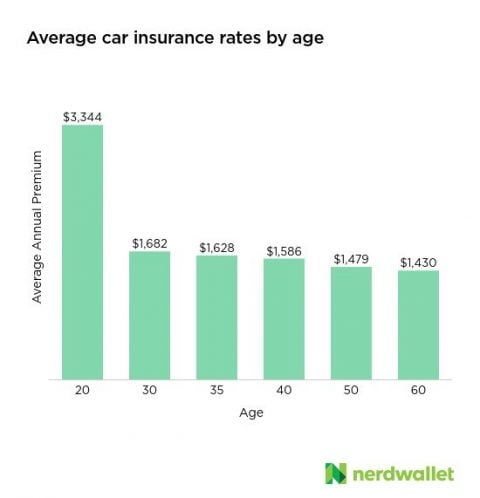

This is a great deal of cash! Let's speak about why it costs so much and also what you can do to help decrease the quantity of auto insurance policy you pay for your young teenage motorist - automobile. Everybody says the magic age is 21. 21 is the age where rates will begin to go down.

How Much Does It Price To Include a 16 Year Old To Automobile Insurance Coverage? As stated above, it can cost a whole lot of money to include your 16 year old to your auto insurance coverage.

Take benefit of the few discount rates available to young motorists (auto). This price cut is not offered with as several insurance coverage business as it utilized to be. It can still be a considerable discount rate and also it's still a valuable course for your young chauffeur to take.

The Greatest Guide To Additional Driver Policy - Budget Car Rental

Just How Much Is Automobile Insurance For a 17 Year Old? While it holds true that cars and truck insurance coverage for a 17 year old is really expensive, it's not almost as poor as a 16 year old with no driving experience! As you age annually your vehicle insurance policy premiums will continue to go down (car insurance).

insurance companies cheapest auto insurance car insurance cheaper car

insurance companies cheapest auto insurance car insurance cheaper car

cheapest car insurance affordable prices risks

cheapest car insurance affordable prices risks

There is a difference in expense between male as well as women motorists. Youthful women chauffeurs will cost less to insure than 17 year old male's.

If a particular danger is less, then the rates for that insurance plan will certainly be much less. When it involves 17 year old ladies, the information reveals that they are much better chauffeurs than 17 year old men - car insurance. Females have a tendency to enter much less mishaps as well as often tend to obtain much less tickets.

Just How Much Is Insurance coverage For a 17 Year Old Male? Male motorists, particularly young male chauffeurs, often tend to have higher prices for automobile insurance policy. This is simply due to the fact that 17 years of age males often tend to have more mishaps and are riskier drivers. Insurer recognize they will more than likely wind up paying cash for the crash the 17 years of age man is mosting likely to have, so they bill higher rates - cars.

The Ultimate Guide To What Determines The Price Of An Auto Insurance Policy? - Iii

They can in some cases have good prices for 16 year olds, yet they can likewise occasionally have poor prices for auto insurance. Somebody that can look at dozens of different companies as well as find the finest rate for your 16 year old.

Nobody intends to pay more money on car insurance for their young adult than they need to! Do I Have To Add My Young Adult To My Insurance policy? Yes, you must add all motorists of your vehicles to your cars and truck insurance coverage. There is a poor rumor available where a great deal of agents are stating that you don't require to include young drivers to your vehicle insurance plan.

This is totally false and these representatives are setting up these individuals to have an awful claim experience where things are covered. Permissive usage is for those people that would drive your lorry that do NOT live in your home and do not drive your lorry often.

vehicle insurance cheapest perks auto

vehicle insurance cheapest perks auto

In numerous situations, if a teenage chauffeur crashes your vehicle and also they are not detailed on your policy as a chauffeur after that there would certainly not be coverage! No, your adolescent chauffeur must not obtain their very own insurance. automobile.

Everything about How Does Car Insurance In Australia Cover Additional Drivers?

Not only is it much more expense reliable to include your teenager to your vehicle insurance policy but it likewise ensures you have the right insurance coverage. Obtaining your teenager their very own vehicle insurance policy while they are living in your house develops all sort of insurance coverage issues that might affect you at the time of a claim (affordable auto insurance).

Some firms want specific types of plans yet don't want various other kinds of plans. So some insurance coverage firms will certainly have truly excellent pricing for teen chauffeurs, due to the fact that they want that type of service whereas various other car insurance business will certainly have really high prices on teenage drivers since that kind of policy is not what they want.

To examine prices with an independent representative, visit this site. insured car.

Including a skilled vehicle driver with a tidy document to your car insurance coverage typically will not cost you even more money. Nonetheless, if you include a motorist to your policy that has current mishaps or traffic violations, the insurance provider might bill you a lot more. Just how much more will certainly rely on just how high-risk the insurance policy company takes into consideration the extra chauffeur to be.

The smart Trick of Add Driver To Insurance - Connect Auto Insurance That Nobody is Talking About

If you are a moms and dad and also you include your young vehicle driver to your plan, it will likely set you back even more to insure him or her on your plan. Teens as well as young motorists, normally under age 26, are considered high-risk chauffeurs by insurance coverage firms, so they pay greater prices than various other age teams (insurers).

You can include a chauffeur to your policy at any kind of time by calling your insurance coverage company and supplying the info. That implies he or she is covered by your policy as an occasional chauffeur, but you will be the key motorist, or the one that drives the automobile most of the time.

Graduated Certificate Discount Rate: The graduated certificate system entitles drivers to a discount rate. If you are including your teenagers to your policy, your prices are mosting likely to boost due to the additional threats that young adults include to a plan (accident). If your teens do not have any type of chargeable sentences and also haven't triggered any type of crashes when they got their Course G2 licenses, you might be able to acquire a 10 percent discount rate.

Mature Driver Price Cut: If the person you would certainly like to add to your plan is 50 years of age or older and also has an excellent driving document, you may certify for the mature chauffeur price cut. If you include a person to your cars and truck insurance policy and offer him or her consent to drive your lorry occasionally, he or she will be covered by your insurance business if he or she is entailed in an automobile crash.

Some Known Factual Statements About Do All Household Members Need To Be On My Auto Policy?

If the crash is triggered by the person that drives your automobile periodically, your insurance coverage firm will certainly raise your prices. If someone obtained your auto and they are not listed as an occasional vehicle driver, your insurance provider will still cover the damages. cars. The driver will be required to fulfill the following qualifications: The chauffeur must have a Canadian chauffeur's permit You must have given the person authorization to drive your lorry The driver must comply with the rules of your plan The individual must not have been driving recklessly or in an impaired or sidetracked state What happens if the periodic driver gets a ticket? Tickets adhere to people, not cars.

You need to still exercise care when choosing that to offer your vehicle to. In Ontario, police can pen your car if you are driving too quick. This means your auto would be hauled and placed in a take whole lot. If your close friend declines to reimburse you for these costs, you'll be on the hook if you desire your cars and truck back.

Broker, Link brokers are always standing by to address any insurance policy related concerns you might have. Periodic Driver Insurance coverage FAQ's An occasional chauffeur is somebody that only obtains your car currently as well as after that.

Finished License Discount: The graduated permit system qualifies vehicle drivers to a discount. If you are including your teenagers to your policy, your rates are going to raise due to the added dangers that young adults contribute to a policy. If your teenagers don't have any type of chargeable convictions and have not triggered any kind of mishaps when they obtained their Class G2 licenses, you might be able to get a 10 percent price cut.

Some Ideas on Finding The Cheapest Car Insurance For Teens - Usnews.com You Need To Know

Keep in mind that the training has to have been completed within 3 years prior. Fully Grown Driver Discount: If the person you would certainly like to contribute to your plan is half a century of age or older as well as has a great driving document, you might qualify for the fully grown chauffeur price cut. What if an Individual Who Drives Periodically Gets Involved In an Accident? If you add an individual to your vehicle insurance coverage as well as give him or her approval to drive your car occasionally, he or she will be covered by your insurance provider if she or he is associated with a cars and truck crash.

If the accident is brought on by the person that drives your automobile periodically, your insurance company will certainly elevate your prices - cheap. If someone obtained your auto and they are not provided as an occasional chauffeur, your insurance firm will still cover the damages. The chauffeur will be called for to satisfy the following credentials: The chauffeur must have a Canadian driver's license You must have offered the individual consent to drive your vehicle The vehicle driver must comply with the regulations of your plan The person must not have been driving recklessly or in an impaired or sidetracked state Suppose the occasional vehicle driver gets a ticket? Tickets adhere to individuals, not cars and trucks.

You should still exercise treatment when picking who to provide your lorry to. In Ontario, police can impound your vehicle if you are driving also fast. This means your auto would be lugged and placed in an impound lot. If your buddy declines to reimburse you for these costs, you'll be on the hook if you want your car back.

Broker, Link brokers are always standing by to answer any type of insurance policy relevant inquiries you may have. Periodic Motorist Insurance Frequently asked question's An occasional driver is someone that just borrows your auto currently and then. cars.

The 6-Minute Rule for How Much Does Your Car Insurance Increase When You Add ...

Graduated Permit Discount Rate: The finished license system entitles motorists to a discount rate. If you are including your teenagers to your plan, your prices are going to enhance due to the fact that of the extra dangers that teens contribute to a policy. If your teenagers do not have any type of chargeable sentences as well as haven't triggered any accidents when they got their Course G2 licenses, you might be able to get a 10 percent price cut.

insurance company insured car cheapest car auto insurance

insurance company insured car cheapest car auto insurance

car insurance insured car auto insurance car

car insurance insured car auto insurance car

Keep in mind that the training must have been finished within three years prior. Fully Grown Driver Discount Rate: If the individual you wish to include in your policy is half a century of age or older as well as has a great driving record, you may certify for the fully grown motorist price cut. What happens if an Individual Who Drives Occasionally Gets right into a Crash? If you include an individual to your cars and truck insurance coverage and also provide him or her authorization to drive your car sometimes, she or he will certainly be covered by your insurance company if he or she is associated with a car collision.

If the accident is triggered by the person that drives your vehicle periodically, your insurer will increase your prices. If somebody borrowed your cars and truck and they are not detailed as an occasional chauffeur, your insurance provider will certainly still cover the problems. The vehicle driver will be required to satisfy the complying with qualifications: The vehicle driver must have a Canadian vehicle driver's certificate You must have offered the individual approval to drive your vehicle The motorist must follow the policies of your policy The individual must not have been driving recklessly or in a damaged or distracted state Suppose the occasional vehicle driver gets a ticket? Tickets follow individuals, not cars.

This means your vehicle would be pulled and placed in a pen whole lot. If your pal rejects to reimburse you for these expenses, you'll be on the hook if you want your car back.

Unknown Facts About How To Avoid Car Rental Additional Driver Fees - Autoslash

Broker, Link brokers are constantly standing by to answer any type of insurance policy associated concerns you may have. Periodic Motorist Insurance policy Frequently asked question's A periodic driver is somebody that just Find out more borrows your car currently as well as after that.